Imagine being able to double your money with investments that promise high returns, no risk, and quick payouts.

Sounds too good to be true, right? That’s exactly how Ponzi schemes catch unsuspecting investors before the scheme eventually fails.

While Ponzi schemes have existed for many years, with countless high-profile cases, many people and businesses continue to unknowingly invest thousands or millions of dollars, only to realise months later they’ve invested in a scam.

Ponzi schemes are particularly successful because many people fail to spot the signs of fraudulent investments. In this blog, we’ll cover the ins and outs of Ponzi schemes, how to avoid them, and what to do if you think you’ve been a victim of investment fraud.

What is a Ponzi Scheme and How Does it Work?

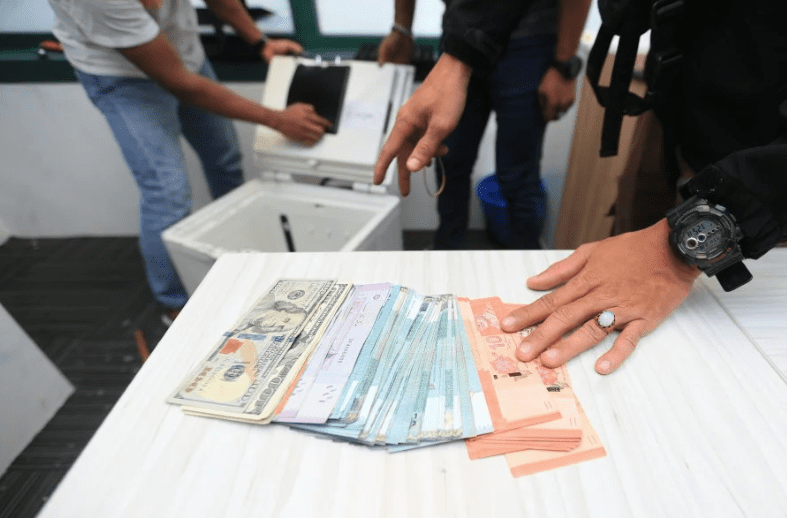

A Ponzi scheme is a type of investment fraud where scammers promise high returns to investors, often claiming that there is little to no risk involved. Instead of creating their profits through legitimate investments, the scheme pays early investors using money from new investors.

This creates an illusion of success for a while, but Ponzi schemes rely on continuous new investors to pay off earlier investors’ returns. Eventually, the scheme collapses once it runs out of new investors.

Ponzi Schemes Vs. Pyramid Schemes

While Ponzi schemes and pyramid schemes are both fraudulent financial scams, there are several differences in the way they operate.

Ponzi schemes focus on fake investments, offering no real product or services. Generally, they’re run by a central operator who controls the money flow, and eventually the scheme collapses when new investments dry up and old investors demand their money back.

Pyramid schemes, on the other hand, rely on recruiting participants, but instead of promising investment returns, pyramid schemes offer incentives for recruiting others. Both Ponzi and pyramid schemes are built on deception and eventually fail, leaving most participants with losses.

How To Avoid a Ponzi Scheme

In order to avoid falling victim to scams, especially Ponzi schemes, it’s important to do your due diligence before investing. Be sceptical of opportunities that claim to help you get rich quick, or offer guaranteed returns. Investment scams can lead to devastating financial losses, and fraudsters often prey on individuals who may not be familiar with the warning signs of financial fraud.

Here’s some things you can do to avoid Ponzi schemes:

- Be sceptical of guaranteed returns. Legitimate investments always come with some level of risk.

- Verify the investment firm. Research the company and check if it is registered with financial regulators like ASIC (in Australia) or the SEC (in the U.S.).

- Get to know how the investment works. If you can’t clearly explain how the investment generates profits, that’s a red flag. Ponzi schemes often use vague or overly complex explanations.

- Be wary of pressure to recruit others. If you’re encouraged to bring in new investors to keep the returns flowing, it could be a Ponzi or pyramid scheme.

- Legitimate investments provide detailed statements and clear records of transactions, so make sure everything is transparent. Ponzi schemes often lack transparency or provide fake documentation.

- Avoid investments that rely on word of mouth. If the primary selling point is trust in a friend, family member, or community leader rather than solid financials, proceed with caution.

- Don’t fall for urgency tactics. Fraudsters pressure people to invest quickly, claiming limited spots or time-sensitive opportunities. Always take the time to research before investing.

- Trust your instincts. If something feels off or too good to be true, seek independent financial advice before investing.

What To Do If You Think You’ve Invested in a Ponzi Scheme

Now that you know what a Ponzi scheme is and how it works, you can start to make better decisions when facing financial investments. If you suspect you’ve fallen victim to a Ponzi scheme, it’s crucial to act fast.

IFW Global has a strong reputation for uncovering financial fraud, including Ponzi schemes, with outstanding results. Our team of skilled investigators specialise in identifying fraudulent investment operations and helping victims take legal action to recover their losses. Whether you’ve been misled by a Ponzi scheme, a fake hedge fund, or another deceptive investment, we’ll make sure you get the support you need.

Contact us today, or take a look at our website for more Ponzi scheme case studies or information on different types of investment fraud in Australia.